by James Agresti

The national debt has risen at a blistering pace over recent decades and is now higher than any era of the nation’s history—even when adjusted for inflation, population growth, and economic growth (GDP).

Denying this reality, Nobel Prize-winning economist Paul Krugman recently wrote two columns for the New York Times in which he claimed that the debt is an “overhyped issue” and “isn’t all that unusual” from a historical perspective. His attempts to support these assertions employ the kind of fraudulent accounting that could land a corporate executive in jail.

Projections v. Realities

Krugman insists that taming the “federal debt should be well down the list” of government “priorities” after “climate change” and “child poverty” because debt projections have become “much less dire” over the past decade or so. In reality, the debt is far higher than projected, and Krugman’s own words prove it.

In 2009, when the Democrat-controlled Congress and President Obama began racking up debt and projecting $9 trillion in deficits over the coming decade, Krugman wrote that “even if we do run these deficits,” federal debt would be 90% of GDP in 2019, or “substantially less than it was at the end of World War II.”

The debt in 2019 turned out to be 109% of GDP, which is 21% higher than Krugman projected and just 8% below the debt from World War II.

That was one year before government reactions to the Covid-19 pandemic drove the debt/GDP ratio to unprecedented heights. This was mainly caused by state government lockdowns that crushed the GDP as the federal government spent liberally on “Covid relief.”

Even though GDP rebounded as lockdowns were lifted, and the worst inflation in 40+ years has temporarily reduced the debt/GDP ratio, it is still higher than any other period of U.S. history, clocking in at 123% of GDP at the end of 2022:

Worse yet, the national debt is on a trajectory that makes the current debt look small by comparison. Under CBO’s decade-old projections, which have thus far undershot reality, the U.S. debt/GDP ratio is on track to eclipse Britain’s after it was intensely firebombed during World War II.

Because the debt from WW II was highest in U.S. history, Krugman and other scholars used to argue that the modern debt situation isn’t awful by comparison. What they failed to mention is that the war debt was a passing anomaly caused by the deadliest and most widespread conflict in world history, while the modern debt is a systemic, escalating problem driven by ongoing federal policies.

If left on autopilot, the debt is on track to double WWII levels in the coming three decades and grow thereafter to about nine times the peak of WWII.

Current Law v. Current Policy

Beyond ignoring his own debt projection, Krugman spins a yarn that is diametrically opposed to reality by exploiting his readers’ ignorance about differing types of debt estimates published by the Congressional Budget Office (CBO).

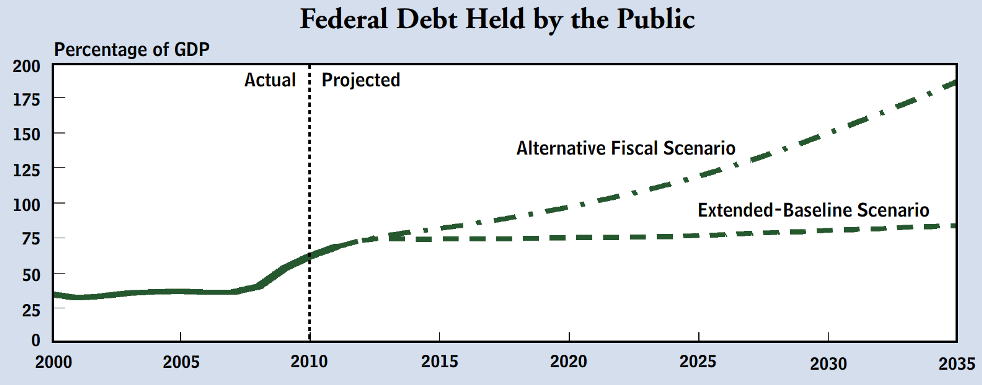

At various times, CBO has calculated two major types of projections for the national debt. The first reflects current law and is called the “extended baseline,” while the other is based on current policy and is called the “extended alternative fiscal scenario.” There are often major differences between these projections, as shown by this chart on the cover page of a 2011 CBO report:

The main reason for these differences is that federal laws are commonly rife with accounting gimmicks and other provisions that understate future debt.

A prime example is the 2010 Affordable Care Act, informally known as Obamacare. This legislation was enacted with a CBO analysis showing it would “produce a net reduction in federal deficits of $143 billion” over the coming decade. In reality, most of the deficit-reducing provisions of the bill weren’t implemented, while nearly all of deficit-increasing ones were.

The chasm between what the Affordable Care Act specified and what actually occurred is so great that its true costs are still unknown. Congress’ Joint Committee on Taxation wrote that it hasn’t calculated the realized budgetary impact of Obamacare “because of the many modifications to that law,” and CBO says it “cannot readily provide a retrospective analysis” of the law.

The bottom line is that the current law scenario made the Affordable Care Act seem like it would lower the debt, but the actual outcome was so different that federal budget agencies don’t know the real number.

Bait and Switch

With those facts in mind, watch how Krugman craftily jumps between current law and current policy projections.

In another of his columns about debt that proved to be dead wrong, Krugman declared in 2013 that “budget office projections show the nation’s debt position more or less stable over the next decade.” Emphasizing that point, he wrote, “So we do not, repeat do not, face any kind of deficit crisis either now or for years to come.”

Krugman’s basis for that claim was CBO’s current law projections, which showed the publicly-held debt/GDP barely changing from 76.3% in 2013 to 77.0% in 2023, a rise of only 1%. What Krugman neglected to reveal is that the current policy projection showed the debt growing by 14% in the same period. And for the record, it has actually grown by about 28%, or 28 times the current law projection cited by Krugman.

Fast forward to 2023, and Krugman is arguing that CBO’s latest debt projections have become “much less dire” since 2011. To support this claim, he compares current policy projections from CBO in 2011 to current law projections from CBO in 2022. He then compares those projections for 2035, thereby avoiding a comparison with actual outcomes.

Adding another layer of deceit, Krugman refers to the 2011 current policy projections in his recent column as “the most realistic scenario.” Yet, he cites the 2022 current law projections in the very same column without giving his readers a hint that he is using the least realistic scenario. He also does the same in his 2009 and 2013 columns.

In short, Krugman stealthily switches between CBO’s current law and current policy projections to weave a counterfactual narrative while avoiding his own failed projections.

Interest Payments

In one particular case, Krugman does compare a projection to an actual outcome. This is CBO’s 2011 current policy projection for interest payments on the national debt in 2021. Krugman correctly notes that CBO projected interest payments would be 4.4% of GDP in 2021, but they turned out to be less than half of that.

Krugman, however, skirts the fact that this outcome comes at a steep cost. During the Great Recession of 2007–2009 and the Covid-19 pandemic, the Federal Reserve suppressed interest rates by minting money to buy federal debt. This temporarily lowers interest payments on the debt, but it also shifts wealth from middle-income households to high-income ones and stokes inflation, which hurts people in the present and drives up interest costs in the future.

In the words of Federal Reserve economist Christopher J. Neely, “unexpected inflation will tend to raise the cost of servicing future U.S. debt” because investors won’t buy it unless interest rates are high enough to account for the inflation.

Krugman gives a tepid nod to that reality by writing that interest payments “will rise as existing debt is rolled over at higher interest rates,” but this is a far cry from admitting all of the harm this portends.

Consequences

One of the most nefarious aspects of government debt is that it hurts people through economic mechanisms that aren’t always obvious to them. This murkiness is aggravated by politicians who run up debt and falsely blame others for the common effects of excessive debt.

Those effects—documented in publications of the Government Accountability Office, the Congressional Budget Office, the Brookings Institution, and Princeton University Press—can manifest gradually or abruptly in the form of:

- reduced “living standards” and “wages.”

- “higher inflation” that increases “the size of future budget deficits” and decreases “the purchasing power” of citizens’ savings and income.

- “losses for mutual funds, pension funds, insurance companies, banks, and other holders of federal debt.”

- increased “probability of a fiscal crisis in which investors would lose confidence in the government’s ability to manage its budget, and the government would be forced to pay much more to borrow money.”

The consequences of government debt are not just potential dangers lurking in the future. They may have already begun. Although association does not prove causation, the rapidly rising national debt of the past few decades has been accompanied by episodes of historically poor growth in GDP, productivity, and household income. These economic outcomes cause a host of negative impacts on human welfare in areas like education, nutrition, healthcare, and life expectancy.

And when such problems occur, politicians and people like Krugman use these hardships to justify running up even more debt. Hence, the harmful effects of government debt continue and escalate.

– – –

James D. Agresti is the president of Just Facts, a research institute dedicated to publishing facts about public policies and teaching research skills.

Photo “Paul Krugman” by Commonwealth Club. CC BY 2.0. Background Photo “U.S. Capitol” by Wiki person that edits. CC BY-SA 4.0.

I’ve been seeing and hearing Krugman’s Antics and Hysteria for at least 2+ Decades, and he has One And Only One claim to Fame/Infamy.

That Little Hobbit Looking joker has Never Ever Been Right About Anything, and with this, his latest nonsense, his record is still in tact.

The best thing I can say about Paulie K is that he is nothing if not Consistent.

Consistently Wrong About Absolutely Everything, and folks dumb enough to take his Financial Advice will end up living in Refrigerator Crates